勞工保險賠償計算

EC Insurance Calculation

根據《僱員補償條例》(香港法例第282章)列明以下適用範圍

僱員因工及在僱用期間遭遇意外而致受傷,或患上《僱員補償條例》所指定的職業病,僱主有責任支付補償;

《僱員補償條例》一般適用於根據僱傭合約或學徒合約受僱的僱員。由香港僱主在本港僱用,而在外地工作時因工受傷的僱員,也受保障。

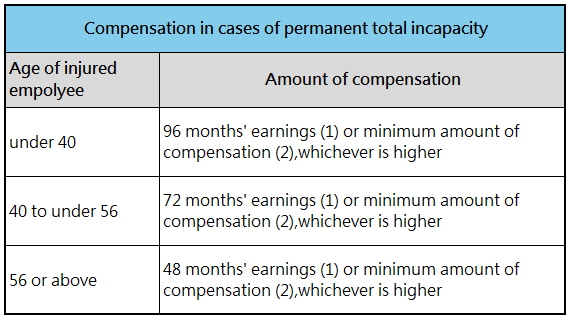

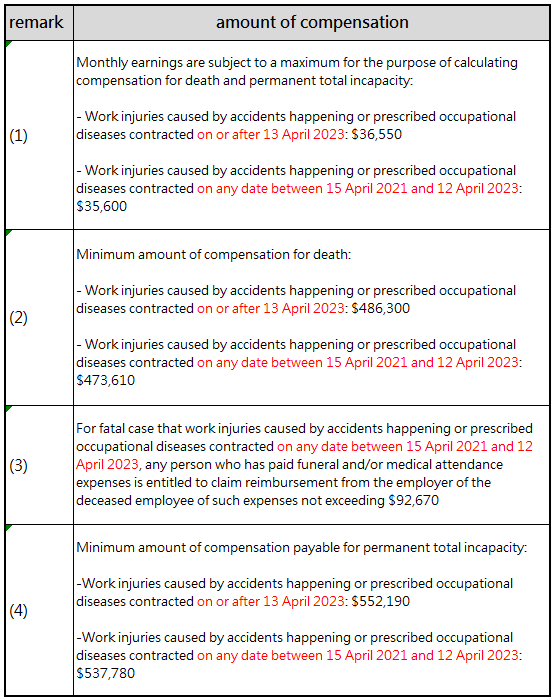

若僱員因工受傷引致永久地部份喪失工作能力,補償金額須視乎僱員喪失賺取收入能力的程度,並參照永久地完全喪失工作能力的補償金額,按比例計算:

永久地完全喪失工作能力的補償金額 | X | 永久喪失賺取收入能力百分率 |

病假醫療用賠償計算

病假可以獲勞工保險賠償,最長24個月。若僱員暫時喪失工作能力的期間超過24個月,可向法院申請延長收取按期付款的期限,但延長期限不可超過12個月。

(發生意外時的每月收入 – 在意外後的每月收入)x 4/5

醫療費用

僱主須支付的醫療費的最高金額如下:

- 對僱員每天身為醫院住院病人進行醫治的費用:300元

- 對僱員每天身為非醫院住院病人進行醫治的費用:300元

- 對僱員在同一天身為醫院住院病人及非醫院住院病人進行醫治的費用:370元

勞工保險索償流程

選用合適表格(附件下載),填妥一式兩份,表格正本交回勞工處,副本連同醫生收據正本及病假紙本交回保險公司。

如僱員需要覆診,需持續把相關覆診文件正本交給保險公司存檔。

傷者痊癒後,由勞工處或醫生安排日期,帶同病假證明書副本,前往勞工處職業醫學組辨理銷假或判傷手續。

當僱主收到由勞工處發出的表格7(評估證明書)或表格5(評定補償證明書),應盡快把正本交給保險公司,以便處理賠償。

一般情況下,僱主需於僱員提交醫療單據、勞工處發出補償評估書(表格5)後(如適用)的21天內支付有關費用。另工傷假錢,則需要按期支付。

簡易處理程序|一般個案(無爭議的工傷個案)

病假不超過3天及沒有導致永久喪失工作能力

僱主應於僱員須獲付工資的相同日期支付工傷病假錢及有關的醫療費,以解決個案。

病假超過3天但不超過7天及沒有導致永久喪失工作能力

僱傭雙方可按法例藉協議決定補償。僱主應於僱員須獲付工資的相同日

期或以前支付工傷病假錢及有關的醫療費,並將有關資料填報於呈報工

傷意外通知書(表格2)之H部分。

According to the Employees’ Compensation Ordinance (Chapter 282 of the Laws of Hong Kong), the following scope of situation will be applied

If an employee is injured due to an accident at work or during the course of employment, or suffers from an occupational disease specified in the Employees’ Compensation Ordinance, the employer is responsible for paying compensation;

The Employees’ Compensation Ordinance generally applies to employees employed under contracts of employment or apprenticeships. Employees employed by Hong Kong employers in Hong Kong and injured at work while working overseas are also protected.

If an employee suffers permanent partial incapacity due to a work-related injury, the amount of compensation shall be calculated in proportion to the extent of the employee’s loss of earning capacity and with reference to the amount of compensation for permanent total incapacity:

Amt of compensation due to permanent total incapacty | X | % of permanent loss of earning capacity |

Calculation of compensation for sick leave and medical expenses

Sick leave can be compensated by EC insurance, up to 24 months. If the employee is temporarily incapacitated for more than 24 months, he or she may apply to the court to extend the period for collecting periodic payments, but the extension period cannot exceed 12 months.

(Monthly income at the time of the accident – Monthly income after the accident) x 4/5

medical expenses

The maximum amount of medical expenses the employer must pay is as follows:

- Cost of treating the employee as a hospital inpatient per day: $300

- Cost of treating the employee as a non-hospital patient per day: $300

- Cost of treating an employee as a hospital inpatient and a non-hospital patient on the same day: $370

EC Insurance Claims procedure

Select the appropriate form (download the attachment), fill it out in duplicate, return the original form to the Labor Department, and return the copy to the insurance company together with the original doctor’s receipt and sick leave certificate.

If the employee needs follow-up medical consultation, he need continue to submit the original copy of the relevant follow-up consultation documents to the insurance company for archiving.

After the injured person recovers, the Labor Department or a doctor will arrange a date and remind to bring a copy of the sick leave certificate to the Occupational Medicine Section of the Labor Department to handle leave cancellation or injury determination procedures.

When employers receive Form 7 (Assessment Certificate) or Form 5 (Assessed Compensation Certificate) issued by the Labor Department, they should submit the original copy to the insurance company as soon as possible for processing of compensation.

Under normal circumstances, the employer is required to pay the relevant fees within 21 days after the employee submits the medical documents and the issuance about the Labor Department compensation assessment letter (Form 5) (if applicable). In addition, work-related injury sick-leave compensation needs to be paid on schedule.

The above information is provide from Waksman, Insurance Broker, Links Wealth Management Ltd

Please feel free to contact insurance broker Links Wealth Management- Waksman Low for any insurance enquiry